charitable gift annuity minimum age

Is a Humane Society gift annuity the right choice for you. Ad Support our mission while your HSUS charitable gift annuity earns you income.

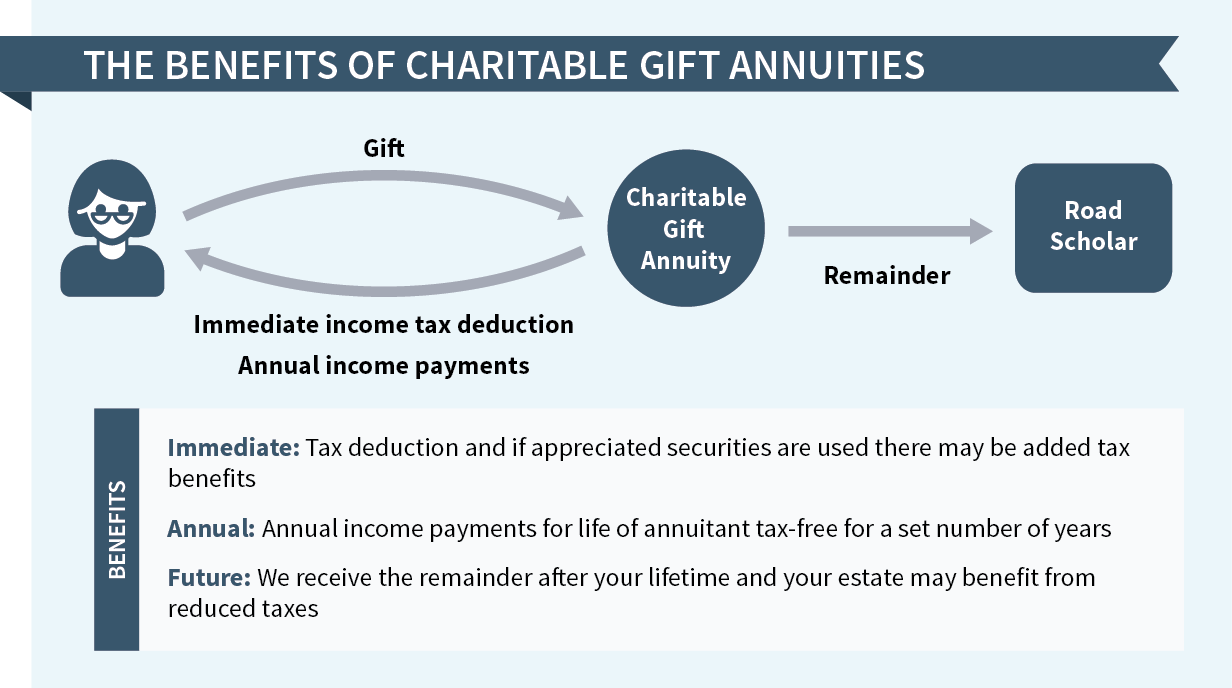

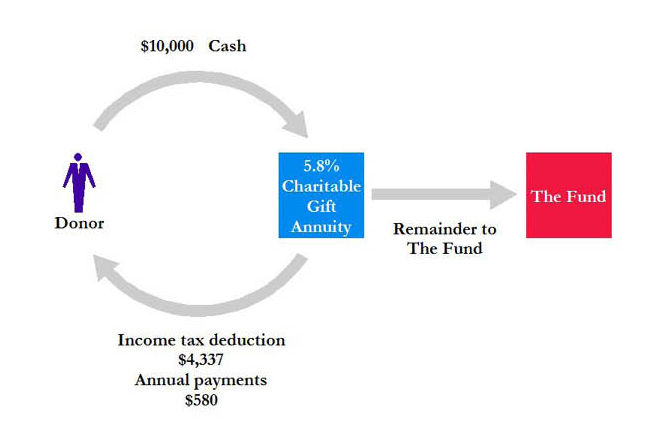

She gets a partial income tax charitable deduction with each gift annuity which helps to lower her current tax.

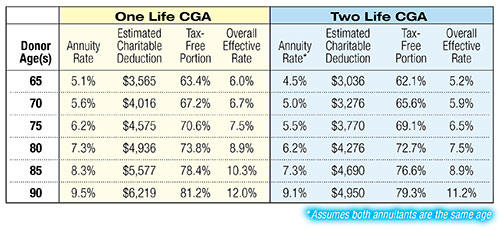

. Their ages at the time of your gift will determine their payment rate. The payment rate for joint gift annuities is lower than the rate. Required form and instructions for non-profit educational religious charitable or scientific institutions seeking a certificate of exemption to issue charitable gift annuities.

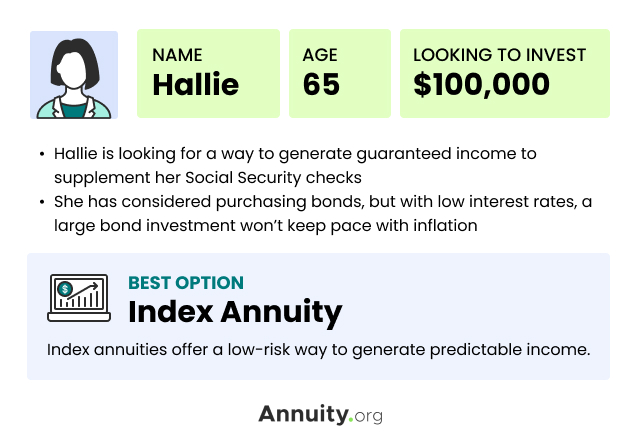

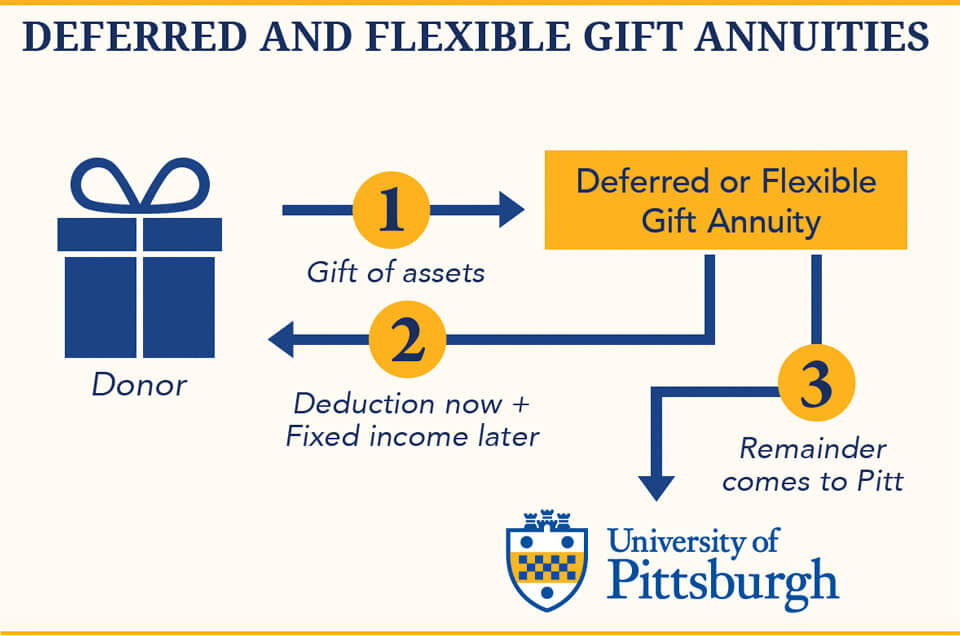

Gift annuities may be funded with cash or securities. If the annuity is deferred it is recommended that the minimum age of the annuitant at the time payments begin be the same as the minimum age of an annuitant of an. A charitable gift annuity provides fixed payments to you or others you name for life in exchange for your gift of cash or securities.

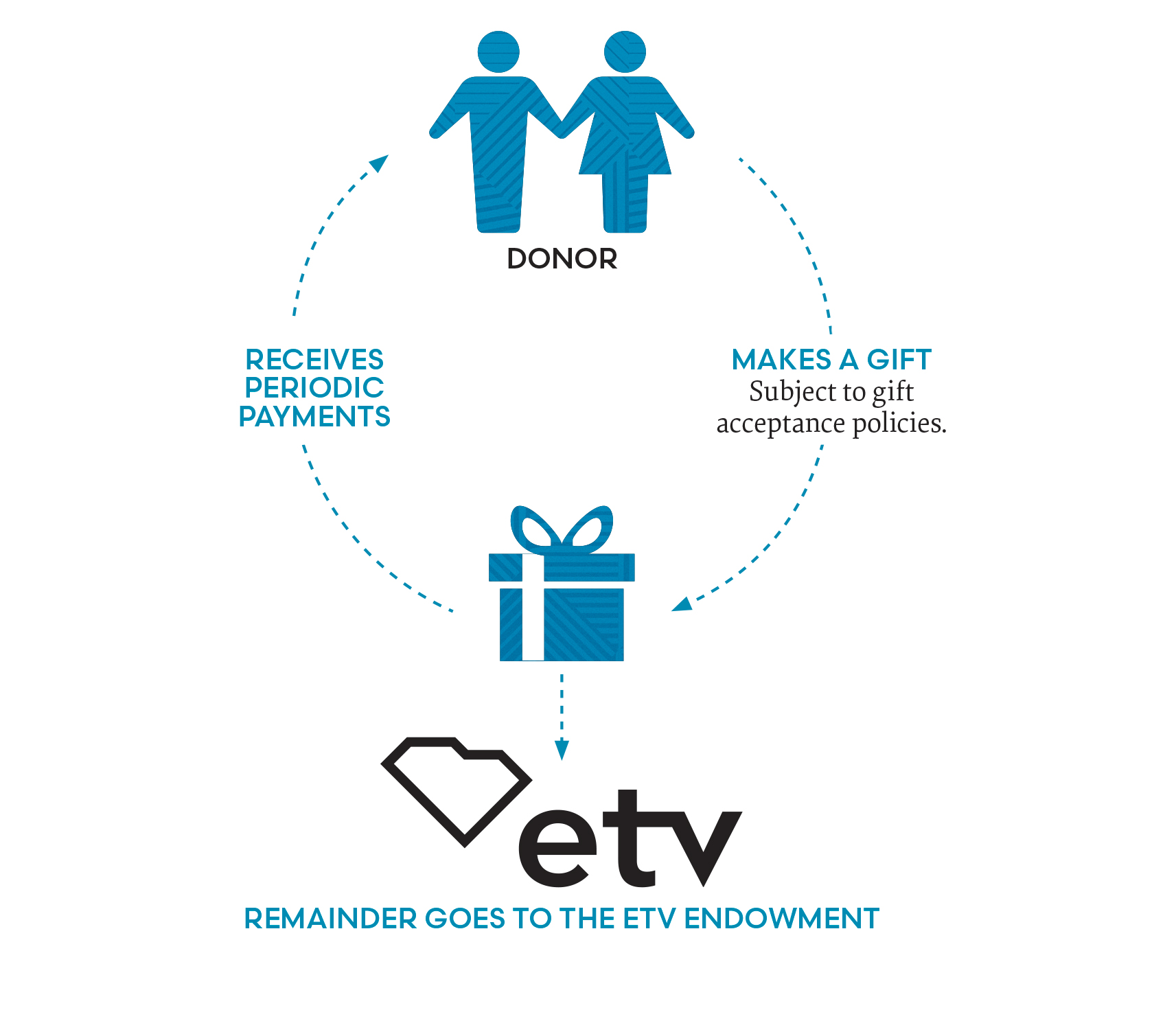

SUGGESTED CHARITABLE GIFT ANNUITY RATES Approved by the American Council on Gift Annuities Effective April 26 2021. Sample Annuity Rates for Gift Amount of 25000. A charitable gift annuity CGA is a concept whereby a donor makes a gift of money or property to charity and the charity gives back an agreed-upon income stream to the.

Ad Support our mission while your HSUS charitable gift annuity earns you income. 125 rows Rates for younger annuitants ages 5 to 50 were reduced as necessary to comply with the 10 minimum charitable deduction required under IRC Sec. The minimum gift is 10000 and the minimum age when payments may begin is 55.

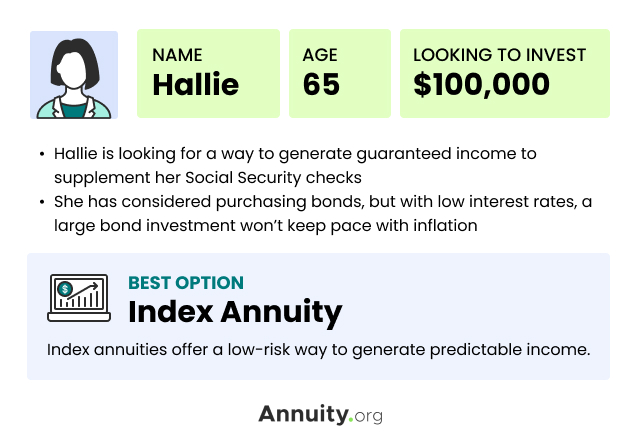

The minimum age to establish a charitable gift annuity is 65 and the minimum amount needed is 20000. Establish minimum ages for immediate and deferred annuities. When you establish a charitable gift annuity with the Oblate Annuity Trust minimum 5000 you will receive annual fixed payments for the rest of.

A charitable gift annuity CGA is both a tax-deductible gift and an income-producing annuity. Creating a charitable gift annuity. Ad Earn Lifetime Income Tax Savings.

A charitable gift annuity. Charitable Gift Annuities. Age Older Age Rate Younger Age Older Age Rate Younger.

Skip to main content. The minimum age to fund an immediate gift annuity is 55. Charitable gift annuities make this possible.

When you establish a charitable gift annuity by gifting cash or stock to Child Evangelism Fellowship you will receive an immediate tax. Minimum gifts for establishing a charitable gift annuity may be as low as 5000 but are often much larger. She elects to fund a series of charitable gift annuities at 10000 per year.

The minimum amount to start an annuity with CFNEK is 25000. Because our donor itemizes their tax deductions they earn a federal income tax charitable deduction of 12027 the amount of the 25000 donation attributable to the gift portion. Is a Humane Society gift annuity the right choice for you.

Give Gain With CMC. Many states that regulate charitable gift annuities require the charity to supply the state with the charitys published gift annuity rate chart of the maximum annuity rates the. For example if you created a 100000 gift annuity at age 70 you could expect to receive 4700 in payments each year.

The minimum age to establish a charitable gift annuity with the Catholic Foundation of Northeast Kansas is 65. Including your ages when you set up the charitable gift annuity. Our minimum age for a payment recipient is 40.

Our minimum age for a payment.

Charitable Gift Annuities Uses Selling Regulations

Acga Charitable Gift Annuity Rates

City Of Hope Planned Giving Annuity

Rising Rates On Charitable Gift Annuities The Institute For Creation Research

Charitable Gift Annuities Road Scholar

Indexed Annuity Pros Cons Fixed Index Equity Index

8 Introduction To Charitable Gift Annuities Part 1 Of 3 Planned Giving Design Center

What Is A Charitable Gift Annuity Actors Fund

Annuities The Catholic Foundation

Turn Your Generosity Into Lifetime Income The Los Angeles Jewish Home

8 Introduction To Charitable Gift Annuities Part 1 Of 3 Planned Giving Design Center

Charitable Gift Annuities The University Of Chicago Campaign Inquiry And Impact

Charitable Gift Annuity Rate Increases Texas A M Foundation

Charitable Gift Annuities Barnabas Foundation

Annuity Annuity Life Insurance Marketing Marketing Humor

City Of Hope Planned Giving Annuity

Charitable Gift Annuities The University Of Pittsburgh